Here’s what you need to know to build your business budget from the bottom up and start the new financial year on the front foot.

BDO Business Services Partner Craig Mitchell recently held a workshop at the Brisbane Business Hub to share his financial forecasting tips with the local business community.

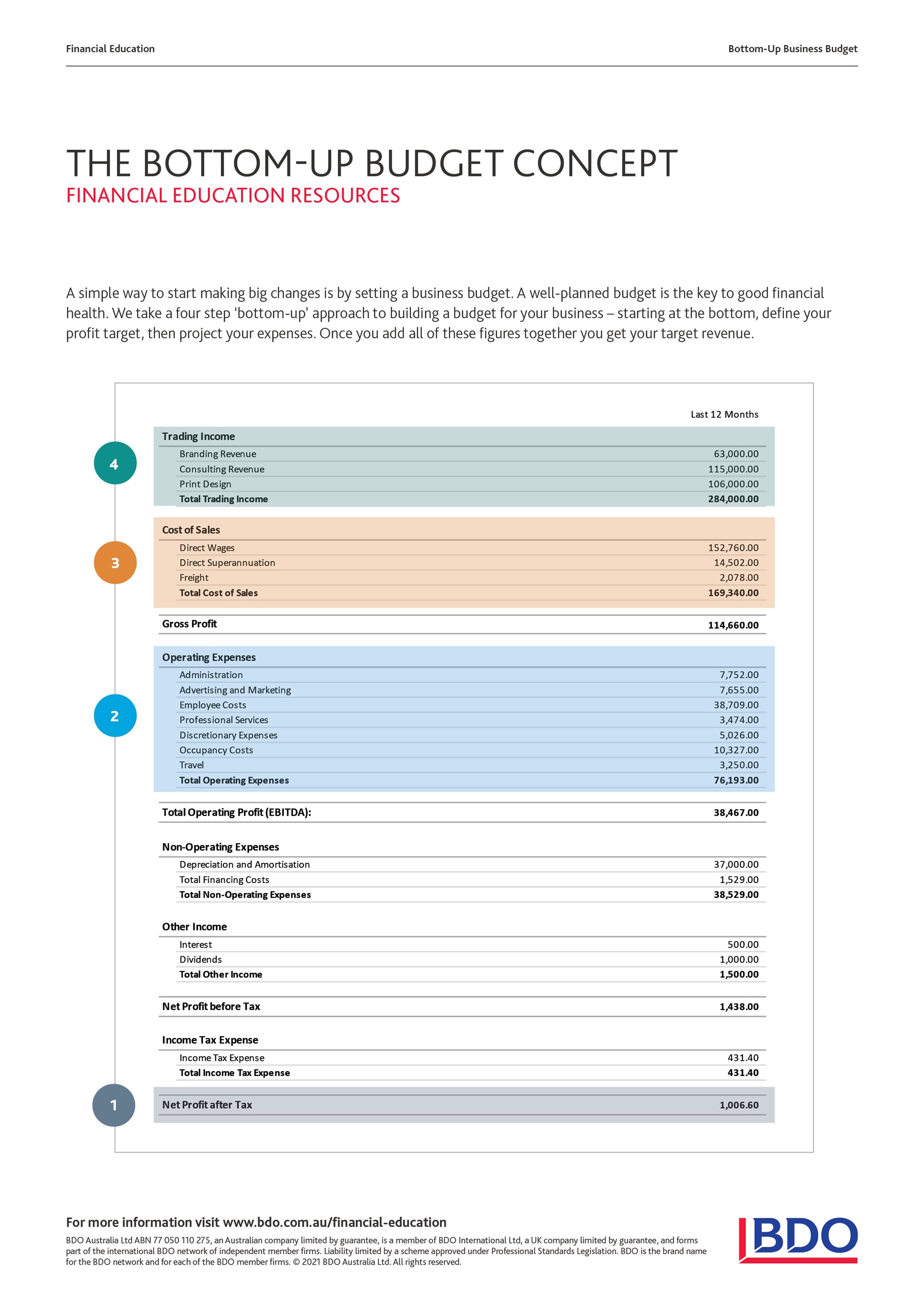

Craig, who also serves as a Financial Educator for BDO’s Business Growth Program, explained that the key to financial health is a well-planned budget, and recommended a four-step ‘bottom up’ approach that puts profit first.

“There are plenty of different methods for budgeting and looking at your financial projections,” he said, “but the goal for most businesses is to get a return out of what they’re doing. The ‘bottom up’ budget is profit-focussed – you start with the profit you want to make, and work your way up from there.

“What we’ve seen with businesses in the past – particularly high-growth businesses – is that if you base your forecasting on top-line revenue, you might end up doubling your revenue but halving your profit, because all your efforts are directed towards maximising your turnover at the expense of profitability.”

STEP ONE: SET A PROFIT TARGET

Since the aim of most businesses is to make a profit, BDO recommends that your bottom-line profit target should come first when you’re building a budget – and you should be aspirational.

“We’ve certainly seen some hard times over the last 12 to 18 months when people haven’t been as positive,” Craig said, “and there are certainly some businesses out there that are struggling, but we encourage people to be ambitious. After all, why are you in business? Whether it’s financial success that drives you or some other form of intrinsic reward, you can only achieve your goals if your business is successful.”

In other words, don’t just aim for the standard increase of five to 10 per cent on the previous year, and don’t think of profit as something that just covers the business owner’s salary, which should be provisioned for in your operating expenses.

Instead, aim to generate a return on all the time, effort and money you’ve invested in your business. You can then use that profit to reinvest in the business, pay down your liabilities, or pay your shareholders a dividend.

STEP TWO: PROJECT YOUR OPERATING EXPENSES

The next step is to carefully consider your operating expenses. These are the costs you incur in your normal business operations – rent, insurance, phone and internet bills are all operating expenses, for instance.

It’s important here that you separate your operating expenses from your Cost of Goods Sold (COGS), which are the costs you incur that directly contribute to making or selling your product or service. COGS are costs that tend to go up as you make more products and deliver more services – these could include labour costs, the cost of materials, or the wholesale cost of goods that you resell, for instance.

Review your operating expenses from the last year, and look to make small reductions wherever you can, because they all add up. Is there anything that can be reduced, removed or renegotiated?

Remember to take into account any planned expenditure for the coming months that might not be reflected in your expenses from last year – if you’re planning to do some repairs and maintenance, rent a new office, invest in a large marketing campaign or employ additional administration staff, for instance, you’ll need to bake these costs into your projected operating expenses.

STEP THREE: PROJECT YOUR COGS

As the cliché goes, it takes money to make money. In order to generate revenue, businesses incur expenses directly related to the products or services they sell – as explained above, this is your cost of goods sold, or COGS. These are also referred to as ‘cost of sales’, ‘inputs’ or ‘direct expenses’.

For a retail-based business, COGS might include things like stock and inventory purchases, freight costs, logistics provider fees, merchant fees, product packaging, or storage costs.

For a service-based business, examples of COGS include wages and salaries of ‘billable’ employees, contractor wages, merchant fees, transport and travel costs, and software subscriptions and equipment costs if they’re used to provide your service.

Separating your COGS from your operating expenses is important, because you need an accurate picture of the costs of delivering your product or service to make sure you’re pricing it correctly.

STEP FOUR: CALCULATE YOUR REVENUE TARGET

Now that you’ve worked out your profit target and the expenses you expect to incur, the last step is to calculate the revenue you’ll need to support your projected budget.

To do this, simply add your net profit target, your operating expenses and your cost of goods sold together. The total figure is your revenue target.

Once you’ve got your revenue target, you can also determine your revenue gap – to do this, just subtract the total revenue you made in the last financial year from your new revenue target. This will show you the gap you need to close in the next year.

“If there’s a huge gap, the first question to ask yourself is if it’s realistic for you to close it,” Craig said. “If it’s totally out of the ballpark, then you need to revisit your budget. But if you think it’s achievable, then your next steps come down to strategy. What can you do in the next financial year to close that gap, in order to achieve the profit goal you’ve set for yourself?”

As the year unfolds, you may find that you’re not hitting your revenue targets, but that doesn’t mean your forecast was a failure.

“There are always opportunities to re-forecast,” Craig said. “It’s good to look at your forecasts on a regular basis, and adjust them to make sure they’re still realistic in the current climate. We’ve just seen this with COVID – when conditions change significantly, you need to revisit your forecast, instead of clinging to a static budget based on what you forecast six months ago.

“It’s not necessarily a bad thing when you’re not meeting your forecast, as long as you can analyse it and understand the variance between what you thought you’d do, and what you’re actually doing. There are usually lessons to be learned there.”